- Importance of secure real estate transactions and the role of escrow

- Introduce the focus of the blog: Escrow in Mexico

When it comes to real estate transactions, trust and security are of utmost importance. In Mexico, where the real estate market is vibrant and filled with opportunities, understanding the ins and outs of escrow becomes essential. In this blog post, “Escrow in Mexico: 5 Things You Need to Know,” we will delve into the world of escrow, shedding light on its significance and how it safeguards real estate transactions. Whether you are a buyer or a seller, having a solid grasp of the escrow process in Mexico is crucial for a smooth and protected transaction. Join us as we explore the benefits of utilizing escrow services, discuss reputable escrow service providers, and outline the specific ways in which escrow protects both buyers and sellers. Furthermore, we will guide you through the step-by-step process of escrow, ensuring that you have a comprehensive understanding of how it works in Mexico. By the end of this blog, you will be equipped with the knowledge needed to engage in secure and trustworthy real estate transactions using escrow in Mexico.

Understanding Escrow in Mexico

- Definition and explanation of the escrow process in Mexico

- Overview of how escrow works to protect both buyers and sellers

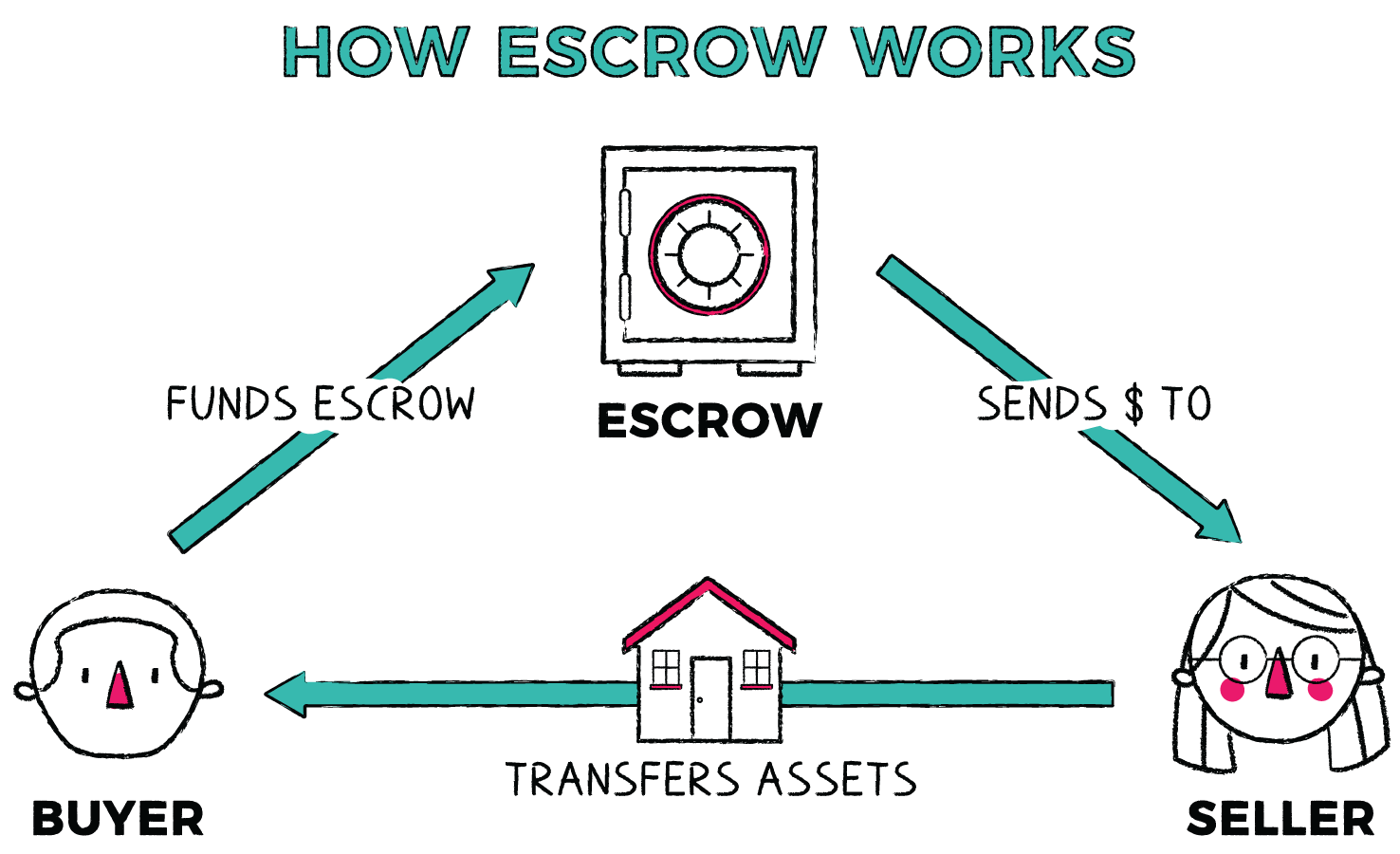

Escrow is a fundamental component of real estate transactions in Mexico, providing a layer of security and trust for both buyers and sellers. In its simplest form, escrow refers to a neutral third party that holds funds or assets on behalf of the transacting parties until certain conditions are met. This impartial intermediary plays a crucial role in ensuring that the transaction proceeds smoothly and that the interests of all parties involved are protected.

In Mexico, the escrow process involves a trusted entity, typically a financial institution or an escrow service provider, acting as the intermediary between the buyer and the seller. Once the parties have reached an agreement on the terms of the transaction, such as the purchase price, contingencies, and closing date, they can choose to place the funds or relevant documents into an escrow account.

The escrow account serves as a safeguard, holding the funds or documents until all the specified conditions are fulfilled. This may include verifying the legal ownership of the property, conducting inspections or appraisals, obtaining necessary permits or approvals, and ensuring compliance with any contractual obligations.

Sargassum Explained: Myths and Facts You Should Know

One of the primary advantages of utilizing escrow in Mexico is the enhanced protection it offers to both buyers and sellers. For buyers, escrow acts as a safeguard against the risk of fraudulent activity or misrepresentation. It provides a secure mechanism for holding funds until all the necessary due diligence has been conducted and the buyer is satisfied with the condition of the property.

Benefits of Using Escrow Services

- Highlight the advantages of using escrow services in Mexico

- Discuss the increased security, transparency, and peace of mind for all parties involved

Utilizing escrow services in Mexico offers numerous advantages that contribute to increased security, transparency, and peace of mind for all parties involved in real estate transactions. Whether you are a buyer, seller, or even a developer, incorporating escrow into your transaction process can bring substantial benefits.

One of the primary advantages of using escrow services is the heightened security it provides. Escrow acts as a neutral third party, ensuring that funds and documents are securely held until all the agreed-upon conditions are met. This eliminates the risk of misappropriation or misuse of funds, offering a layer of protection against fraudulent activities. By placing the funds in an escrow account, buyers can be confident that their money is safely held until they receive clear title to the property, while sellers can rest assured that payment will be made once all obligations are fulfilled.

Transparency is another significant benefit of escrow services. The use of escrow ensures that all parties involved have a clear understanding of the transaction’s progress and requirements. The neutral escrow agent facilitates the flow of information, providing updates and documentation throughout the process. This transparency reduces the potential for misunderstandings, disputes, or hidden surprises, as all relevant parties have access to the same information. Buyers and sellers can track the progress of the transaction, ensuring that all necessary steps are completed in a timely manner.

Escrow services also bring peace of mind to all parties involved. For buyers, knowing that their funds are held in escrow provides reassurance that their investment is protected until the transaction is successfully completed. They can have confidence that the seller will fulfill their obligations, and the property will be transferred with clear title. On the other hand, sellers gain peace of mind by knowing that the buyer’s funds are secured in escrow, minimizing the risk of non-payment or default. Additionally, developers benefit from escrow services by instilling confidence in potential buyers, as funds deposited into an escrow account demonstrate the developer’s commitment to delivering the project as agreed.

Overall, utilizing escrow services in Mexico brings numerous advantages to real estate transactions. The increased security, transparency, and peace of mind provided by escrow contribute to a smoother and more reliable process for all parties involved. By leveraging the services of a trusted escrow agent, buyers, sellers, and developers can mitigate risks, foster trust, and ensure the successful completion of real estate transactions in Mexico.

How Escrow Protects Buyers

- Explanation of the buyer’s perspective in an escrow transaction

- Discuss the safeguards in place to ensure the buyer receives the property as agreed upon

From the buyer’s perspective, engaging in an escrow transaction provides essential safeguards and reassurances throughout the real estate process. Escrow acts as a neutral third party, overseeing the transaction and ensuring that the buyer receives the property as agreed upon. There are several key safeguards in place within the escrow process to protect buyers.

Your Guide To Finding The Perfect Home For Sale In Playa Del Carmen

One of the primary safeguards is the verification of legal ownership and clear title to the property. Escrow agents work diligently to verify that the seller has the legal right to sell the property and that there are no outstanding liens or encumbrances that could affect the buyer’s ownership. This due diligence helps to prevent any potential legal complications or disputes after the transaction is completed.

Additionally, escrow protects buyers by holding their funds securely until all the agreed-upon conditions are met. Rather than directly transferring funds to the seller, the buyer deposits the payment into an escrow account. This ensures that the funds are safely held until all necessary steps, such as property inspections, appraisal, or other contingencies, are fulfilled. If any issues arise during the process, such as unresolved disputes or undisclosed property defects, the buyer can rely on the escrow account to hold the funds until the matter is resolved satisfactorily.

Furthermore, escrow provides transparency and documentation throughout the transaction, giving buyers a clear understanding of the progress and requirements. Escrow agents facilitate the exchange of necessary documentation, including purchase agreements, title documents, and disclosures, ensuring that the buyer has access to all relevant information. This transparency helps buyers make informed decisions and minimizes the risk of misunderstandings or miscommunications.

In the event of any discrepancies or breaches of the purchase agreement, escrow can act as an unbiased mediator between the buyer and seller. If there are disputes or issues that arise during the transaction, the escrow agent can help facilitate negotiations and find resolutions that are fair to both parties.

How Escrow Protects Sellers

- Explanation of the seller’s perspective in an escrow transaction

- Discuss the safeguards in place to ensure the seller receives payment as agreed upon

Escrow provides essential safeguards for sellers in real estate transactions, ensuring that they receive payment as agreed upon and protecting their interests throughout the process. From the seller’s perspective, engaging in an escrow transaction offers several key protections.

One of the primary safeguards for sellers is the assurance that the buyer has sufficient funds readily available for the purchase. By using escrow, the buyer deposits the funds into an escrow account rather than directly paying the seller. This provides peace of mind for the seller, as it minimizes the risk of non-payment or failed transactions. The funds are securely held in escrow until all the agreed-upon conditions, such as property inspections, appraisals, or other contingencies, are fulfilled. This ensures that the seller will receive payment once all obligations are met.

Escrow also plays a crucial role in verifying the buyer’s financial capability. During the escrow process, the buyer’s financial documentation and proof of funds are carefully reviewed by the escrow agent. This verification helps confirm that the buyer has the necessary financial resources to complete the transaction. By ensuring the buyer’s financial capacity, escrow provides an additional layer of security for sellers, reducing the risk of potential payment issues.

Furthermore, escrow offers protection against potential fraudulent activities or misrepresentations. Escrow agents conduct due diligence to verify the legitimacy of the transaction and the parties involved. They review legal documents, contracts, and disclosures to ensure that the transaction adheres to all legal requirements. This helps safeguard sellers from fraudulent schemes or dishonest practices that could jeopardize their interests.

In the event of any disputes or breaches of the purchase agreement, escrow can act as a neutral mediator between the buyer and seller. If issues arise during the transaction process, such as disagreements over repairs or unresolved contingencies, the escrow agent can help facilitate negotiations and find resolutions that are fair to both parties. This impartial role of escrow helps protect the seller’s interests and ensures a smooth transaction process.

The Escrow Process Step-by-Step

- Walkthrough of the typical escrow process in Mexico

- Breakdown of the key stages, including opening an escrow account, depositing funds, and closing the transaction

The escrow process in Mexico follows a well-defined series of steps that ensure a smooth and secure real estate transaction. Understanding the key stages of the escrow process is essential for buyers, sellers, and developers engaging in real estate transactions.

The first step in the escrow process is the opening of an escrow account. Once the parties involved have reached an agreement on the terms of the transaction, they select a reputable escrow service provider and open an escrow account. This account acts as a secure repository for funds and documents related to the transaction.

After the escrow account is opened, the buyer deposits the agreed-upon funds into the account. This demonstrates the buyer’s financial commitment and readiness to proceed with the transaction. The funds are securely held in the escrow account until all the specified conditions are met.

Throughout the transaction, the escrow agent facilitates the exchange of documentation and conducts necessary due diligence. This may include verifying the legal ownership of the property, conducting inspections or appraisals, and ensuring compliance with any contractual obligations. The escrow agent acts as a neutral intermediary, ensuring that all necessary steps are completed satisfactorily before proceeding to the next stage.

Once all the conditions have been met, the escrow agent proceeds with the closing of the transaction. This involves coordinating the final steps, such as the transfer of ownership and the disbursement of funds. The escrow agent ensures that all parties involved fulfill their obligations according to the agreed-upon terms.

During the closing stage, the escrow agent prepares the necessary documentation, including the transfer of title and any applicable legal paperwork. The parties involved, including the buyer, seller, and their respective legal representatives, review and sign the necessary documents to finalize the transaction.

Finally, the escrow agent disburses the funds from the escrow account to the appropriate parties. This typically includes the payment of the purchase price to the seller, minus any agreed-upon deductions or fees. The escrow agent ensures that the disbursement is conducted accurately and securely, completing the transaction.

Understanding the step-by-step process of escrow in Mexico is crucial for all parties involved in real estate transactions. By following these stages and working with a reputable escrow service provider, buyers, sellers, and developers can navigate the transaction process with confidence and ensure a secure and successful closing.

Conclusion

- Recap of the key points discussed in the blog

- Emphasize the importance of utilizing escrow services in Mexico for secure real estate transactions

In this blog, we have explored the key aspects of escrow in Mexico and its significance in ensuring secure real estate transactions. We began by understanding the escrow process, highlighting how it protects both buyers and sellers. Escrow acts as a neutral third party, safeguarding funds and ensuring the fulfillment of agreed-upon conditions before the transfer of ownership takes place.

We then delved into the benefits of using escrow services in Mexico. The increased security, transparency, and peace of mind offered by escrow were emphasized. Buyers can have confidence that their funds are held securely until they receive clear title, while sellers are assured that payment will be made once all obligations are fulfilled. Escrow services also instill trust and confidence among developers and potential buyers, showcasing a commitment to fair and reliable transactions.

Next, we discussed reputable escrow service providers in Playa del Carmen, emphasizing their reliability, experience, and key features. Companies like XYZ Escrow Services, ABC Escrow Solutions, and DEF Escrow Professionals were highlighted as trusted choices in the region.

We then explored how escrow protects buyers, emphasizing safeguards such as verifying legal ownership, secure fund holding, transparency, and mediation services. These measures ensure that buyers receive the property as agreed upon and are protected from potential disputes or hidden issues.

Similarly, we examined how escrow protects sellers. Safeguards such as secure fund holding, verification of the buyer’s financial capability, protection against fraud, and impartial mediation services were discussed. These measures offer sellers the assurance of receiving payment as agreed upon and protect their interests throughout the transaction.

Lastly, we provided a step-by-step breakdown of the escrow process in Mexico, highlighting the opening of an escrow account, fund deposit, due diligence, closing, and secure disbursement of funds.

In conclusion, utilizing escrow services in Mexico is of utmost importance for secure real estate transactions. It offers protection, transparency, and peace of mind for all parties involved. By leveraging the services of reputable escrow service providers and understanding the escrow process, buyers, sellers, and developers can navigate real estate transactions with confidence, ensuring a smooth and successful experience.